The Ultimate Guide To How To Start Trading Forex

Wiki Article

The Greatest Guide To How To Start Trading Forex

Table of ContentsThe smart Trick of How To Start Trading Forex That Nobody is Talking AboutExcitement About How To Start Trading ForexRumored Buzz on How To Start Trading ForexWhat Does How To Start Trading Forex Mean?See This Report about How To Start Trading Forex

The most fundamental kinds of foreign exchange professions are long and also short trades. In a lengthy trade, the trader is betting that the money price will raise as well as that they can make money from it. A brief profession consists of a wager that the currency set's cost will certainly decrease.

Facts About How To Start Trading Forex Uncovered

While helpful, a line chart is generally made use of as a beginning factor for further trading analysis. Each bar chart stands for one day of trading as well as includes the opening cost, highest possible rate, most affordable price, as well as closing cost (OHLC) for a profession.Colors are occasionally made use of to show rate activity, with eco-friendly or white utilized for periods of climbing costs as well as red or black for a duration throughout which prices decreased. Bar graphes for money trading help traders determine whether it is a customer's or seller's market. Japanese rice investors first made use of candle holder graphes in the 18th century.

The top part of a candle light is utilized for the opening cost and highest possible price factor of a money, while the reduced section suggests the closing rate and also cheapest price point. A down candle light stands for a period of declining prices and is shaded red or black, while an up candle light is a duration of enhancing costs as well as is shaded green or white.

How To Start Trading Forex Things To Know Before You Buy

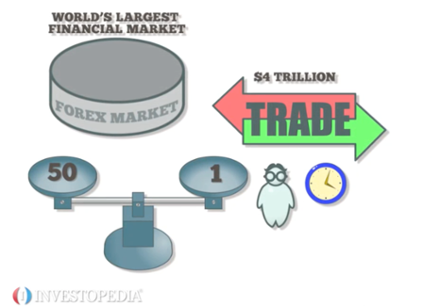

Several of the more usual developments for candle holder charts are hanging guy and also shooting star. Pros Largest in regards to everyday trading quantity worldwide Traded 24-hour a day, 5 and also a half days a week Starting capital can quickly increase Generally follows the very same rules as normal trading Extra decentralized than traditional stock or bond markets Cheats Leverage can make foreign exchange professions really unpredictable Leverage in the variety of 50:1 is typical Calls for an understanding of financial basics and indicators Less regulation than other markets No income creating instruments Forex markets are the largest in regards to day-to-day trading volume worldwide as well as as a result use the a lot of liquidity.The foreign exchange market is traded 24-hour a day, five and a fifty percent days a weekstarting each day in Australia as well as ending in New York. The broad time perspective and also coverage offer traders possibilities to make revenues or cover losses. The significant forex market facilities are Frankfurt, Hong Kong, London, New York City, Paris, Singapore, Sydney, Tokyo, and Zurich.

Foreign learn this here now exchange trading normally complies with the same rules as normal trading as well as requires much less initial capital; for that reason, it is much easier to begin trading forex than supplies. The foreign exchange market is extra decentralized than traditional supply or bond markets. There is no central exchange that dominates money trade operations, as well as the potential for manipulationthrough insider details about a company or stockis lower.

Little Known Facts About How To Start Trading Forex.

Banks, brokers, as well as suppliers in the forex markets allow a high amount of utilize, suggesting traders can regulate large settings with fairly little money (how to start trading forex). Utilize in the range of 50:1 is usual in foreign exchange, read this though also better amounts of leverage are offered from certain brokers. Utilize needs to be made use of meticulously because several unskilled traders have actually endured substantial losses utilizing even more leverage than was required or sensible.

The Only Guide for How To Start Trading Forex

Nations like the USA have innovative infrastructure as well as markets for forex trades. Foreign exchange trades are tightly controlled in the U.S. by the National Futures Organization (NFA) as well as the Product Futures Trading Commission (CFTC). Due to the heavy use of utilize in foreign exchange professions, establishing nations like India and also China have limitations on the firms and also resources to be used in forex visit the website trading.(FCA) displays and regulates foreign exchange trades in the United Kingdom. Currencies with high liquidity have a ready market and display smooth as well as foreseeable rate action in feedback to outside occasions.

For those with longer-term horizons as well as even more funds, long-lasting fundamentals-based trading or a carry trade can be profitable. An emphasis on recognizing the macroeconomic principles that drive money worths, as well as experience with technical evaluation, might help brand-new foreign exchange investors end up being a lot more successful.

Report this wiki page